benefit in kind lhdn

Benefit-in-kind which is not convertible into money. Ascertainment of the Value of Benefits in Kind 3 6.

Edgar Filing Documents For 0001640334 22 001282

Particulars of Benefits in Kind 4 7.

. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money. Accommodation or motorcars provided by employers to their employees are treated as income of the employees. Other Benefits 14 8.

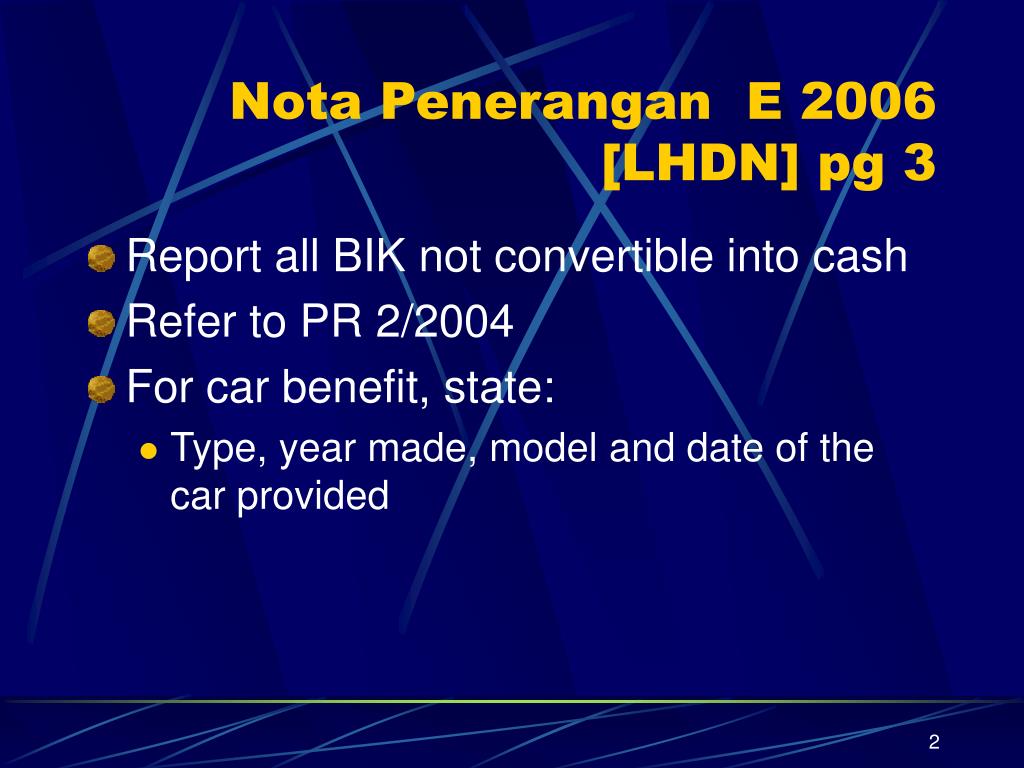

Employers should indicate in the respective EA form the type year and model of the car provided to the employee. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. The LHDN provides for perquisites from employment under Public Ruling No.

Thats because we need to file tax exemptions based on LHDNs Public Ruling 112019 for the valuation of BIK under section 83 Non-application. Purchase Cost of Car Prescribed Average Lifespan of Car x 80 RM 96000 8 Years x 80 RM 9600 According to the Formula Method. These benefits can also be referred to as notional pay fringe benefits or.

This means that when the benefit is provided to the employee that benefit cannot. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit. The section mandates that.

Benefits-in-kind BIKs are benefits provided to the employee by or on behalf of the employer that cannot be converted into money. An employee may benefit from their employment by receiving a benefit that does not take the form of money. Such profits are often called benefits in kind.

44 VOLA is living accommodation benefit provided for the employee by or on behalf of. What is benefit-in-kind BIK. Taxation of benefit-in-kind Valuation of benefits Private use of employer-provided vehicles Private use of employer-provided vans Travel passes or air miles.

These non-monetary benefits are considered as income to the. This benefit which arises in respect of having or exercising an employment is to be included as gross income of the employee from the. Benefits-In-Kind dated 15 March 2013.

Benefits in Kind - LHDN was created by Chian Wei. Section 623 ITEPA 2003. Tax exemption on benefits-in-kind received by an employee 21 Benefits-in-kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from.

Motor cars provided by employers are taxable benefit in kind. Benefits in Kind 2 5. A benefit-in-kind BIK is any non-cash benefit of monetary value that you provide for your employee.

A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia. Only company vehicles. Annual Value of Company Car Benefit.

Generally non-cash benefits eg. 7 months 3 weeks ago 4098. Based on Section 13 1 c the value of living accommodation benefit benefit in kind works out to be the lower amount of the defined value of living accommodation and 30 of gross.

Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who. Just like Benefits-in-Kind Perquisites are taxable from employment income. Computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

Hi Kap-Chew Would ask for your favourite how to set the benefits in. Tax Exemption on Benefits in Kind Received by an Employee. The employment income for women returning to work after a career break of at least 2 years is exempted for up to a maximum of 12 consecutive months application to Talent Corporation.

Only company vehicles the use of which is authorised for personal use including days of rest and leave are subject to benefit in kind. When taxable BIKs must be added to the payroll so they can. Treatment on BIK is explained in detail in the PR No.

Cp650 Income Tax Fill Online Printable Fillable Blank Pdffiller

Benefits In Kind Bik In Malaysia Hills Cheryl

Explanatory Notes Lembaga Hasil Dalam Negeri

Lhdn Irb Personal Income Tax Relief 2020

What Is Form Ea Part 1 Defining The Benefits In Kind

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Amazon Com Bovine Colostrum Capsules With Immunoglobulin G Colostrum Supplement And Muscle Builder For Gut Health Joint Support Immune Boost Bone Strength And Brain Support Probiotic Supplement Health Household

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Covid 19 Lhdn Provides Tax Relief For Vaccinations Screenings Under 2021 Assessment The Star

Updated Guide On Donations And Gifts Tax Deductions

Perquisites From Employment Lembaga Hasil Dalam Negeri

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Income Tax Relief Items For 2020 R Malaysianpf

8 Tax Deductions That May Save You Some Cash In 2022

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Ppt Form Ea Powerpoint Presentation Free Download Id 3261816

0 Response to "benefit in kind lhdn"

Post a Comment